Generally, when the business of a pharmaceutical giant reaches a plateau, its business volume won’t change much during this period. Instead, it will try to optimize its structure, including R&D and production lines.

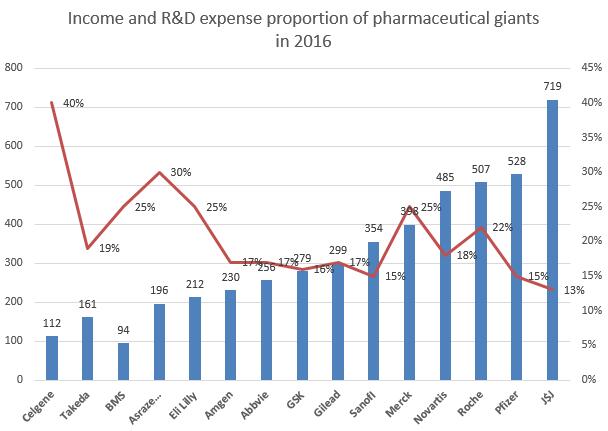

Similarly, it is not often to see erratic fluctuations in the R&D expense of pharmaceutical giants. Most of the time, it sustains a steady increase. However, the R&D expense of Merck in 2016 surged 3.4 billion US dollars. This year, we found through statistics that the total R&D expanse of TOP 5 pharmaceutical enterprises has reached about 5 billion US dollars, among which Roche and Merck ranked first and second respectively. Gilead also increased its investment in R&D, and spent 2 billion US dollars more than last year. While, it was not an easy year for Eli Lilly in terms of R&D, as it experienced the failure of Solanezumab and Baricitinib one after another.

The main reason for their increase in R&D expanse is that they all saw the value of the tumor therapy area, tumor immune therapy in particular. Senior players have begun to divide ‘territory’, such as Bristol-Myers Squibb’s opdivo focused on PD-1 inhibitor field and Merck’s keytruda. Other players will soon be forced to leave the table. In a word, they have to speed up the progress before considering the return.

In addition to develop new products relying on their own R&D team, acquisition is also a shortcut. One of the two biggest acquisition events of last year was Pfizer’s acquisition of Medivation for 14 billion US dollars. The outside world explained that Pfizer wanted to strengthen its own product line by this acquisition. It can obtain enzalutamide for prostate cancer and talazoparib for breast cancer through this acquisition. The other event was Johnson & Johnson’s acquisition of Swiss biotech company Actelion for 30 billion US dollars. Analysts said that Johnson & Johnson wanted to buy some potential products before the arrival of patent expiration. However, the outside world’s evaluations to these two acquisitions were different. The final result needs further observation.

1. Roche

Roche, the Swiss headquartered pharmaceutical giant, has been taken up the top positions of R&D expense for a few years. The R&D departments are mainly gRED in Basel and gRED in California. It also improves its R&D line through cooperation. Recently, Roche reached an agreement with Bristol-Myers Squibb to co-develop adnectin, a drug used to treat duchenne muscular dystrophy (DMD). In the cooperation, Roche needs to pay $170 million in advance, and $205 million follow-up project support costs.

At present, Roche already has several blockbuster products in product line. In March of this year, FDA approved Roche’s monoclonal antibody drug Ocrevus (ocrelizumab) for relapsing multiple sclerosis (RMS) treatment and primary progressive multiple sclerosis PPMS) treatment. The outside world commented that this drug had the potential to change the treatment pattern of multiple sclerosis, and were optimistic about its future prospects. Last year, Roche also introduced the dominant PD-L1 inhibitor tecentriq.

With today’s situation where drug combination strategy wins the market, the success of a drug can lead to a variety of follow-up strategies, just like Roche’s Phase III clinical trials of combination drug that is in progress at this moment. It was found by comparing that the combination scheme of combing Perjeta (ER2/neu receptor antagonist) and Herceptin did better than traditional treatment for early stage post-operative breast cancer patients in reducing mortality and relapse rates.

It was noted that the success of the clinical trial will further strengthen Roche’s position in the field of tumors. In addition, Roche’s Alecensa also defeated Pfizer’s Xalkori in competing for the top position of treating ALK+ lung cancer.

Roche also expects emicizumab to make great achievements in the treatment of hemophilia. However, taking into account the death of the Phase III clinical trial and a series of side effects, the outside world begins to doubt the safety of this drug.

In the field of Alzheimer’s disease treatment, the failure of Gantenerumab is regrettable, while it also urges people to think about how much we know about AD.

2. Merck

To say Merck’s R&d director Roger M. Perlmutter saved Merck’s R&D line may be overstating, but he did stop Merck from missing the blockbuster drug keytruda. After staying in the market of cancer immunization, Merck began to expand the application rang of keytruda. There are currently more than 10 keytruda-based clinical Phase III research are in progress.

Ertugliflozin, co-developed by Merck and Pfizer, is in the process of approving by Europe and the United States. Taking into account its good performance in Phase III clinical trial, these two pharmaceutical companies should have a good expectation to the drug.

Merck’s biggest setback in last year is the failure of Verubecestat targeting for mild to moderate Alzheimer’s disease in Phase III clinical trial. Currently, there is no company that can break the curse of AD drug research and development.

Merck doesn’t seem to keen to it in terms of acquisition. It spent $95 million in the acquisition of Israel’s cCAM, trying to stabilize its position in the field of immune tumors by acquiring the company’s product line. However, it failed in Phase I clinical trial.

3. Novartis

Novartis’ kisqali was approved by the FDA at the beginning of 2017. Kisqali (ribociclib,formerly known as LEE011) was combined with aromatase Inhibitors as an initial endocrine regimen for female patients with HR-positive, HER2-negative advanced or metastatic breast cancers. With excellent clinical data, it is expected to have an annual sale of $2.5 billion.

The clinical study of Psoriasis IL-17 blockers new drug Cosentyx shows better results than similar products. Along with Johnson & Johnson’s Stelara and Amgen’s Enbrel, it is expected to replace their blockbuster drug position in the future.

Zykadia (Ceritinib) was also given priority in the treatment of ALK+ non-small cell lung cancer recently as well as breakthrough therapy designation in lung cancer brain metastases.

In contrast, the FDA’s positive attitude towards CAR-T should be Novartis’ most pride of this year. As a pioneer of CAR-T, its CTL019 will also be a blockbuster drug.

The field of cardiovascular disease will no longer be a specialty of Novartis after the Entresto patent expires. Entresto’s sales having been poor, serelaxin’s failure in clinical trial and competitors already exists in this field are all challenges to Novartis’ strength in the field of cardiovascular.

Maybe the huge market in the field of cardiovascular is taken into account, Novartis has never given up this field. In 2016, it reached an agreement with Ionis by $1.65 billion to co-develop two cardiovascular drugs.

Novartis made a series of adjustments to the company’s structure by the end of 2016, which is also the highly efficient way of running Novartis in facing the declining revenue – optimizing the structure and layoffs, including disbanding the company’s cell and gene therapy sector.

4. Pfizer

In 2010, when Pfizer’s CEO was still Ian Read, the company did not have too many research projects. Relying on the company’s strong financial resources, Ian Read established a R&D product line through acquisitions.

The immune checkpoint project Avelumab co-developed with Merck (Germany) is one of them. It was officially approved for the treatment of metastatic megal cell carcinoma patients who had received at least one course of chemotherapy this year.

Pfizer spent $295 million working with Opko to co-develop long-acting growth hormones. However, the phase III clinical trial result released in October last year was a failure.

5. Johnson & Johnson

Johnson & Johnson is quite special in the list. This company is consisted of three segments, including pharmaceuticals, consumer goods and medical equipment, but it is quite a large value considering only its investment in drug R&D.

Johnson & Johnson is actively working with small businesses around the world in order to expand its business fields. Perhaps there may be surprises. In March 2010, Johnson & Johnson published the Phase III clinical study of IL-23 monoclonal antibody Guselkumab for the treatment of moderate to severe plaque psoriasis. Although the drug R&D progress is slow, it was worthwhile from the results.

Multiple myeloma drug darzalex has been regarded as a potential blockbuster drug by the industry, but Johnson & Johnson has a conservative valuation for this drug. Johnson & Johnson itself does not deny that Guselkumab and Sirukumab will take up dominant position in the future.

Humira is still the global sales champion currently, so rheumatoid arthritis has been a major field for pharmaceutical companies. Johnson & Johnson’s sirukumab is one of them. While, the feedback (due to security issues, the jury voted down its approval by 12:1) of recent FDA expert jury showed that this idea might probably be stranded.

The result of the clinical trial of antidepressant drug Esketamine will soon be published. Johnson & Johnson acquired Apalutamide for the treatment of non-metastatic ovariasis against prostate cancer in 213. It is unknown whether Apalutamide will bring new dominant drugs for it after spending so much money in the acquisition.

Johnson & Johnson’s R&D line is in good condition. Of course, just like other pharmaceutical giants, acquisition is a good solution when their development reached the period of stagnation, Johnson & Johnson, for instance. It spent $30 billion in the acquisition of Actelion this year, so as to enter the arterial hypertension market.